Expert Tips for Investing in Precious Metals

Understanding Precious Metals

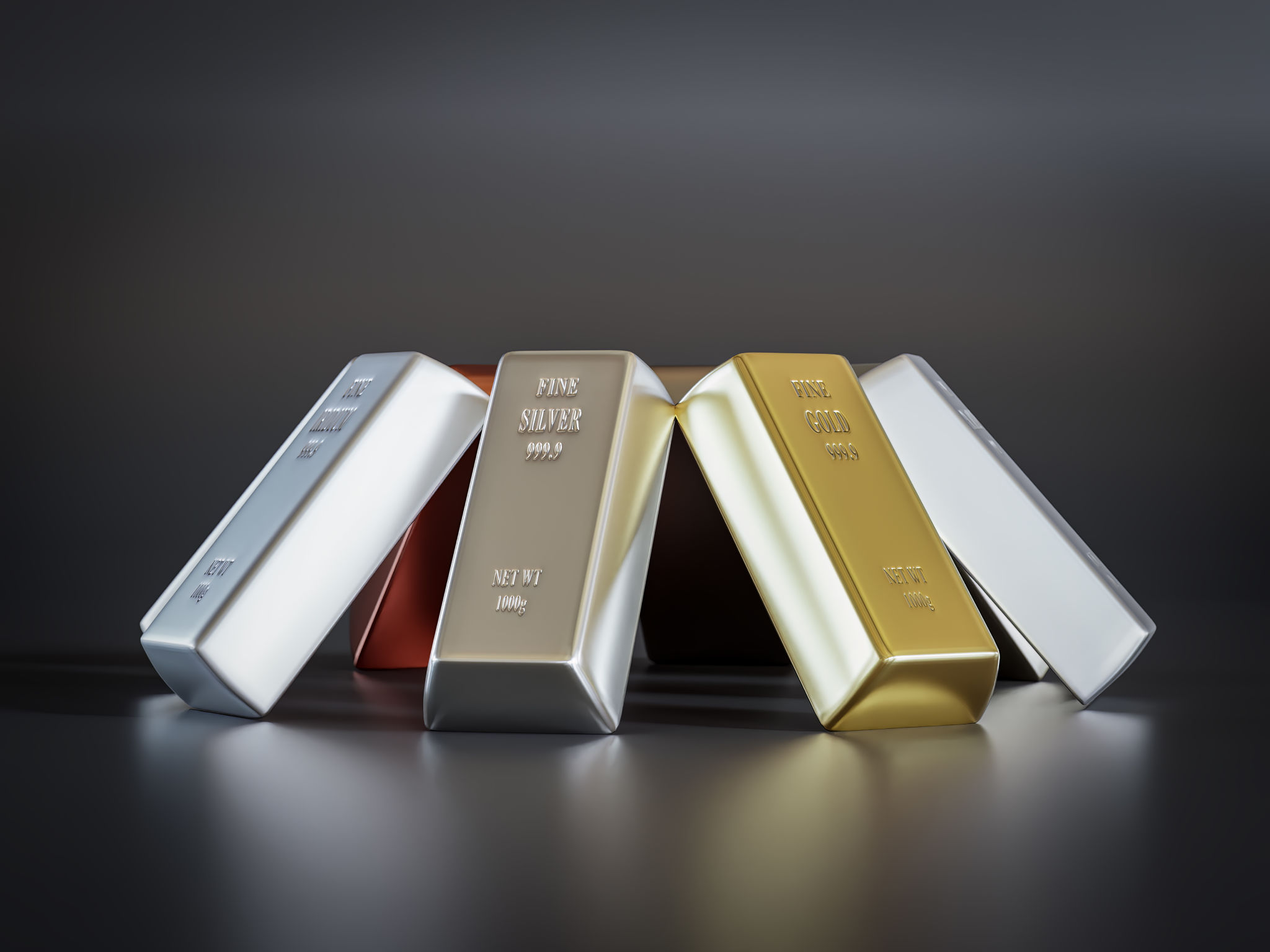

Investing in precious metals can be a lucrative way to diversify your portfolio and hedge against economic instability. Precious metals, such as gold, silver, platinum, and palladium, have historically retained their value over time. They are tangible assets that offer security in uncertain financial climates. Before diving into this market, it's crucial to understand the basics of precious metals investment.

Why Invest in Precious Metals?

Precious metals are often seen as a safe haven during economic downturns. Unlike stocks and bonds, which can fluctuate wildly based on market conditions, precious metals tend to hold their value. Gold, in particular, is renowned for its ability to maintain worth. Investors often turn to precious metals when inflation is high or when there's geopolitical uncertainty, as they provide a stable store of value.

Diversification Benefits

Adding precious metals to your investment portfolio can provide diversification benefits. Diversification helps in spreading risk across different asset classes. When the stock market is volatile, precious metals often perform well, providing a much-needed balance to your investment strategy.

Key Considerations Before Investing

Before investing in precious metals, consider your investment goals and risk tolerance. Precious metals can be bought in various forms such as coins, bars, or exchange-traded funds (ETFs). Each option has its pros and cons. For instance, physical gold provides ownership of a tangible asset, but it comes with storage and insurance costs.

Research the Market

Conduct thorough research before making any investment decisions. Understand the factors that influence the prices of precious metals, such as currency fluctuations, interest rates, and industrial demand. Staying informed will help you make educated decisions about when to buy or sell.

Investment Strategies

There are various strategies for investing in precious metals. Some investors prefer a long-term approach, holding onto their metals for years or even decades. Others take advantage of short-term price fluctuations by actively trading. Consider your time horizon and financial goals when choosing an investment strategy.

Consider Costs

Be aware of the costs associated with investing in precious metals. These can include transaction fees, storage fees for physical metals, and management fees for ETFs. Understanding these costs will help you calculate potential returns more accurately.

Risks Involved

Like any investment, there are risks involved with investing in precious metals. Prices can be volatile, and market conditions can change rapidly. It's essential to be prepared for potential downturns and to not invest more than you can afford to lose.

Seek Expert Advice

Consulting with a financial advisor who is knowledgeable about precious metals can provide valuable insights and help you make informed decisions. An expert can assess your financial situation and suggest the best way to incorporate precious metals into your portfolio.

Conclusion

Investing in precious metals can be a smart move for those looking to diversify their portfolios and protect against economic uncertainties. By understanding the market, researching thoroughly, and considering your investment goals and risk tolerance, you can make informed decisions that align with your financial objectives.